NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

October 25, 2024

Dear Shareholder,

It has been one year since I’ve been at the helm of Muzhu as its new CEO. Over the course of this time, I’ve been inspired by both the diversity of our investor community as well as the passion with which many of you have embraced the Muzhu story at this early stage of development. The fact that many of our shareholders are active, working professionals in the mining industry is not only extremely validating of what I believe to be our Company’s tremendous potential but truly humbling to my personal mission to realize the ambitious goals I have set out to accomplish with the guidance and support of our highly experienced Directors and Advisory Board.

To our shareholders who may be new to the exploration and mining sector and to those who are considering investing, welcome aboard! I wanted to take this opportunity to frame our story in plain language, as I see it, at this point in time.

The Muzhu Story (Chapter One)

As of this writing, the gold and silver markets are on fire. Silver is trading at over USD $33.90 an ounce. Gold reached a historic high of over USD $2,732 per ounce over the last month. Investors are not only seeking out these metals as a “safe haven” but also for their projected long-term industrial demand that is expected to increase significantly over the next 10 years. There can be no doubt that the fundamentals for these commodities are acting as a wind in the sails for many of the early-stage exploration and mining companies. What I believe sets our company apart is not just the good timing of the moment but the unique characteristics of our holdings.

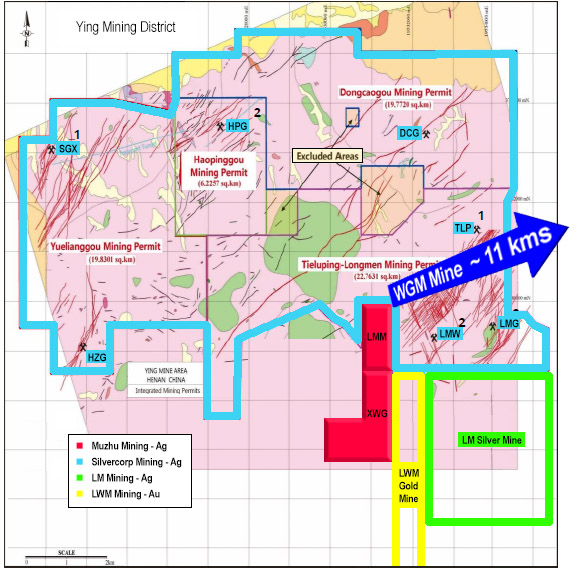

Our properties are doubly blessed by virtue of their being located in some of the most fertile metal resource regions in the world and their close proximity to well-established, producing mining operations. Muzhu currently has 4 unique properties in its portfolio: the Sleeping Giant South property in Quebec, Canada, and three properties located in the highly coveted Ying Mining District in the Henan Province of China. These are the XWG, LMM, and a portion of the WGM property.

The Ying Mining District has historically been a reliable and prosperous source of silver, zinc, lead, and gold mining for hundreds of years. Modern (government-related) exploration dates back to the 1950’s. The region was put on the map some 50 years later when a then little-known Canadian company named Silvercorp Metals had the uncanny good sense to select this region for exploration and mining. Twenty years later, Silvercorp Metals is now the largest producer of silver in China.

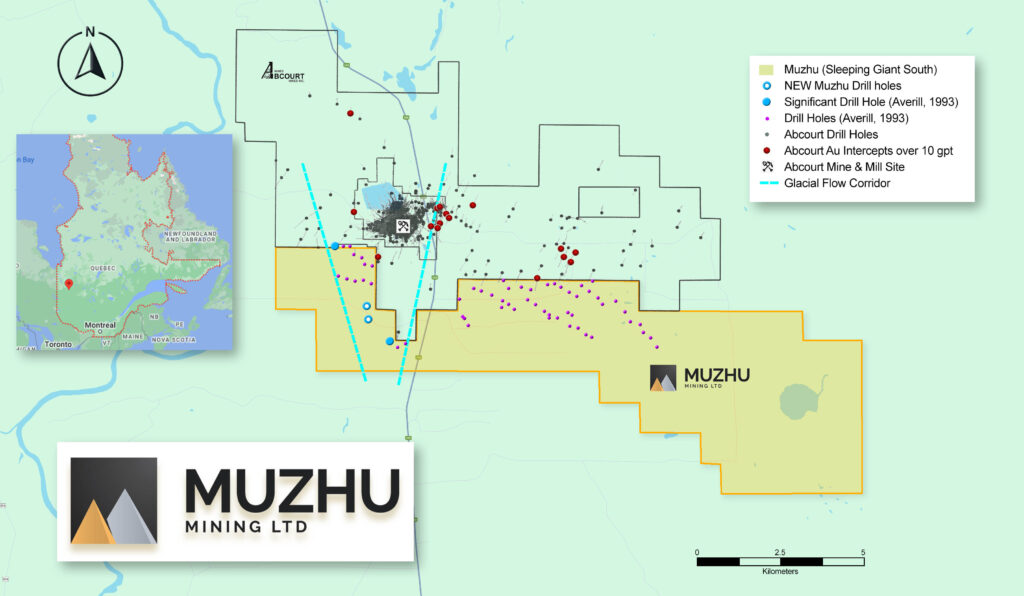

Our fourth property is located in a region of Quebec, Canada that has been successfully mined as the primary source of gold in Canada for over a hundred years. Straddling the provinces of Quebec and Ontario, the Abitibi Greenstone Belt has produced more than 130 million ounces of gold to date with an additional reserve, estimated to be well over 170 million ounces, still in the ground. What grapes are to Napa Valley, gold is to the Abitibi Greenstone Belt. It is considered one of the most highly productive regions in the world for gold production.

Similar to our three Ying Mining District properties in China, we believe Muzhu’s future potential can be seen and validated by the early success, in Quebec, of the adjacent Sleeping Giant Mine which was just recently rehabilitated by Abcourt Mining to process the ramping up of their gold production after an extensive and ambitious period of exploration.

“A Good neighbor is a found treasure.”

————————–Old Chinese Proverb

The Laws of Geology have no respect for boundaries and property lines. We believe that to be a good thing because we can use the data points from our adjoining neighbors in both mining districts to get a sense of the unrealized possibilities of our Muzhu assets. By fully understanding the qualities which have led to our neighbor’s success we can begin to embrace our own prospects as not only possible–but achievable–and within our grasp. Let’s take a moment and do a deeper dive into how the implementation of our neighbor’s successful strategies creates a roadmap for future exploration, development and production of our Company properties.

Abcourt, Sleeping Giant: Abitibi Mining District, Quebec, Canada

In 2016, Abcourt embarked on an ambitious, meticulously executed 8-year exploration and drilling plan to define and confirm potential mineral resources at their Sleeping Giant property. (You can see it here: https://abcourt.net/ Make sure to click on the various headings (Maps/Excavations/Drillholes/Resources) The end result of these efforts can be seen in a striking 3D rendering which maps in vivid detail the depth and location of over 846 distinct gold structures derived from 1.19 million metres of drilling.

From the December 2022 NI 43-101 report the Measured and Indicated resources were listed at approximately 173,000 ounces of gold and the Inferred resource was listed at approximately 248,000 ounces. More drilling is currently underway to further expand the property’s resources. See Abcourt’s October 2, 2024 news release outlining the previously identified resources and the newly commenced drill program to enhance current resources. https://abcourt.info/news/abcourt-begins-a-drilling-campaign-to-enhance-the-mining-potential-at-depth-at-the-sleeping-giant-mine/

At 16,013 acres, Abcourt’s Sleeping Giant Mine is only slightly larger than the 15,195 acres of Muzhu’s 100% owned Sleeping South property. Muzhu and Abcourt share a common property boundary that traverses almost all of the east-to-west claim block. We believe there is a very strong likelihood that the same type of mineralization being mined by Abcourt Mines extends into Muzhu’s property.

In June of this year, Abcourt announced the sale of 345 ounces and the pouring of its first gold dore bar from 1,428 tonnes of ore processed at the 100% wholly-owned Sleeping Giant mine and mill. Abcourt’s goal is to increase this production to 2,500 ounces of gold per month. The fact that this mine and mill is now fully operational and contains all of the necessary infrastructure to process over 750 tonnes of ore a day is a positive indicator of Muzhu’s potential success.

Muzhu has been working with SL Exploration to collect and review historical data and to analyze the information to develop an exploration plan for 2024 and 2025. News to follow regarding the Sleeping Giant South exploration plan.

Silvercorp, Ying Mining District: Henan Province, China

Silvercorp’s initial entry into the Ying Mining District was in 2004 with the SGX mine. After confirming the presence of several lead veins, Silvercorp enacted an unusual strategy of bypassing the usual costly and time-consuming exploration process by jump-starting production. This strategy allowed Silvercorp to generate revenue which provided them with the necessary capital to acquire other properties in the district and avoid unnecessary dilution in their share structure.

By 2008, additional land acquisitions rapidly increased their holdings to a total of 7 mining properties and secured their control over the area. Silvercorp’s seven Ying District mines have produced over 4 million ounces of silver, 49.6 million pounds of lead, and 15.9 million pounds of zinc.

Sixteen years later, by fiscal year-end 2024, Silvercorp reported its Operational Results of:

Silver equivalent (only silver and gold) of 6.8 million ounces, 63.2 million pounds of lead, 23. Million pounds of zinc and the extraordinary addition of over 7,268 of gold.

Muzhu Mining has an option to acquire an 80% stake in what is referred to as the XWG property and an option to acquire an 80% participation in the joint-ventured LMM property. Just as Muzhu’s Sleeping Giant South is adjacent to Abcourt Mines’ property, Muzhu’s XWG and LMM properties are encircled by, and in close proximity to, Silvercorp’s 7 operating mines.

As a result of the Ying Mining District hosting several operating mines in addition to Silvercorp’s 7 operating mines, there exists a well-established infrastructure in the area. Muzhu will be a beneficiary of the existing roads, water, power, a skilled local workforce, and the multiple nearby processing mills. One such processing mill is the Jinqiao floatation mill, 9 km away, which has a processing capacity of up to 1,000 tonnes per day (t/d).

On September 23, 2024, Muzhu announced a Prospecting Agreement with the Louning County Qian Shan Mining Co. Ltd. and its Chinese subsidiary to explore a specific region of the gold-mineralized WGM mine. Similarly, the WGM mine has access to roads, power, and water as well as 2 processing mills less than 10 kms away. Muzhu is currently active on the property and is looking forward to issuing progress reports in the near future.

Final Thoughts

Given the abundance of enviable opportunities that exist in our Quebec and China holdings, at a relatively lean, fully diluted 38 million shares, our team has made a conscientious effort to position the Company for success in the coming years. As evidenced by the Prospecting Agreement we signed a few weeks ago, we have a great team on the ground in China diligently on the lookout for finding under-the-radar deals that make both strategic and financial sense within the framework of our overall strategy.

As Abcourt continues to release positive data on their ongoing exploration and mining operations at Sleeping Giant, I believe we can take some comfort in knowing that what’s good for the goose is good for the gander.

Finally, for me personally, when I take into account the current price of gold and silver, the lack of new-found resources, and the big-picture economic demands at this unique time in our history, I can’t think of a more exciting time to be involved in the mineral exploration and mining sector.

Dwayne Yaretz,

CEO

Muzhu Mining Ltd. Phone: 778-709-3398

Email: [email protected]

Website: muzhumining.ca

Muzhu Mining Ltd. is a Canadian publicly traded exploration company with a portfolio of highly prospective projects at various stages of development. Muzhu currently holds 100% interest in the Sleeping Giant South Project, located in the Abitibi Greenstone Belt, approximately 75km South of Matagami, Quebec. As well, Muzhu has executed two option agreements to acquire up to 80% of the Silver, Zinc, Lead XWG and LMM Properties in the Henan Province located in China.

Neither the Canadian Securities Exchange (the “CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.